Tax Information

Homeowners Age 65+ OR DISABLED: No Tax Increase

Under state law, as long as a homestead and over 65 or disabled exemption application have been filed with the local appraisal district, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older (or disabled) cannot be increased above the amount paid in the first year after the person turned 65 – regardless of changes in tax rate or property value – unless significant improvements are made to the home, increasing the overall value.

If you are 65 + or disabled, you must file a homestead application at your appraisal district to receive the exemption. Please contact your county appraisal district office with questions.

Understanding the Tax Rate

A school district's total tax rate is made up of two parts, which divide the school district budget into two “buckets” - the maintenance and operations (M&O) rate and the interest and sinking (I&S) rate. Each has a designated purpose and budget.

M&O Tax Rate vs. I&S Tax Rate

The M&O budget is used for daily operations of the district, including utilities, salaries, supplies, repairs, and fuel.

The I&S budget is used to repay debt for capital improvements through voter-approved bonds. These improvements can include new construction, renovations, HVAC and roofing replacements, land purchase, furniture, and technology.

Bond elections only affect the I&S tax rate. Funds from a bond CANNOT be used as part of the M&O budget or to increase salaries.

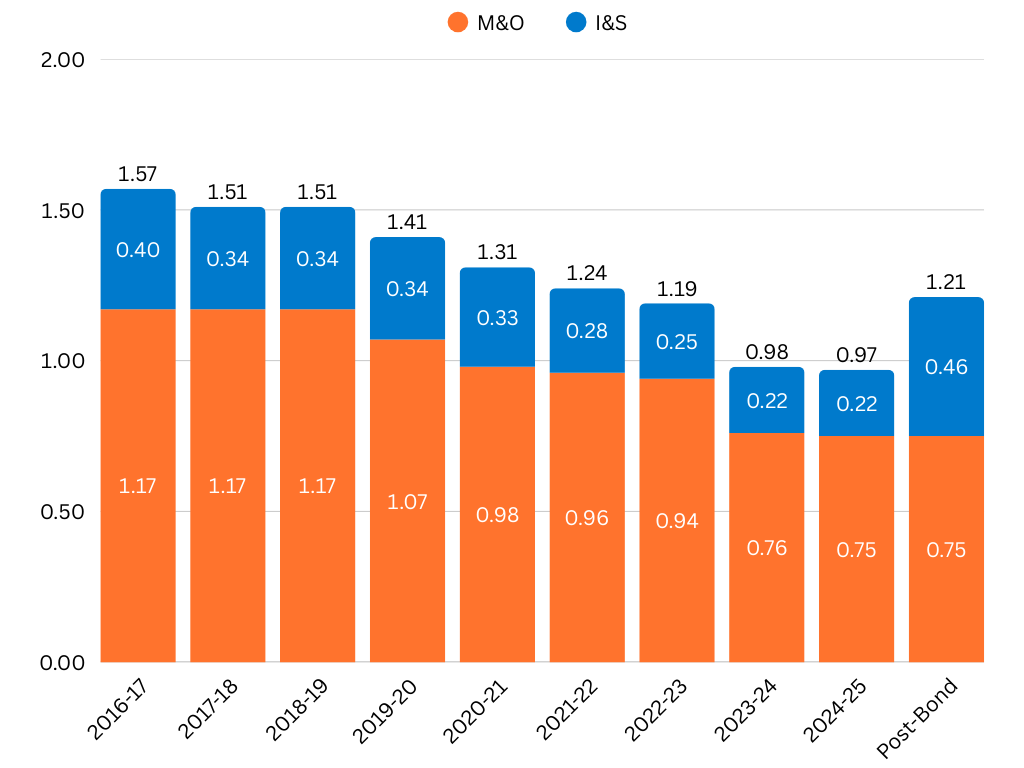

KEMP ISD SCHOOL TAX RATE HISTORY

While the average home value in Kemp ISD has grown, the current school tax rate is the lowest it has been in over 20 years.

Over the years, Kemp ISD has made the choice to lower the I&S rate for local taxpayers.

The proposed total tax rate ($1.217733 per $100 of property value) is still lower than the total tax rate over 10 years ago.

2016-17

KISD School Tax Rate - $1.57

Average Home Value - $136,924

2024-25

KISD School Tax Rate - $0.974433

Average Home Value - $269,318

How Does the Bond Impact Taxes?

If approved, the maximum estimated tax impact would be an additional 24.1 cents to the current Kemp ISD tax rate.

Impact to PROPERTY OWNERS

The average home value in Kemp ISD is $269,316. Based on that average and with the current homestead exemption, a property owner could expect the monthly impact to be $34 if the bond were to pass.

The Texas Legislature has proposed an increase to the homestead exemption. On average with the proposed homestead exemption, a property owner can expect a tax impact of $25.97 a month if the bond passes in May AND the increased homestead exemption is passed in November.

PROPERTY VS SCHOOL DISTRICT TAX RATE

Your property taxes are locally assessed taxes determined by numerous taxing units and the county appraisal district.

Various local taxing units (LTU*), including the school district, establish individual budgets and tax rates, which combined with the appraised value of your home, make up your overall property tax rate.

Your home appraisal value typically changes yearly and is set by your county’s appraisal district. Kemp ISD has no authority on your home appraisal value and cannot raise or lower your appraised rate.